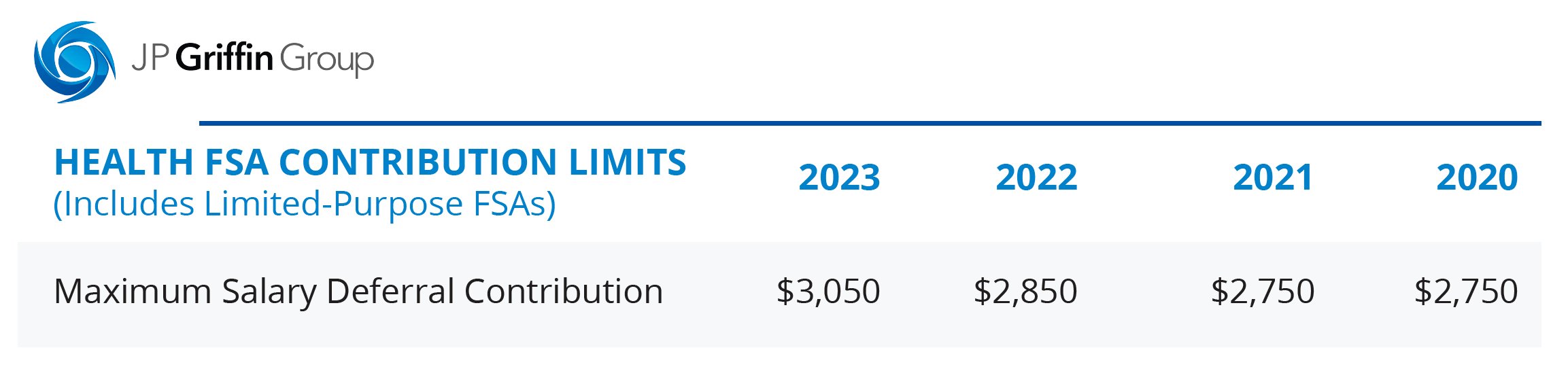

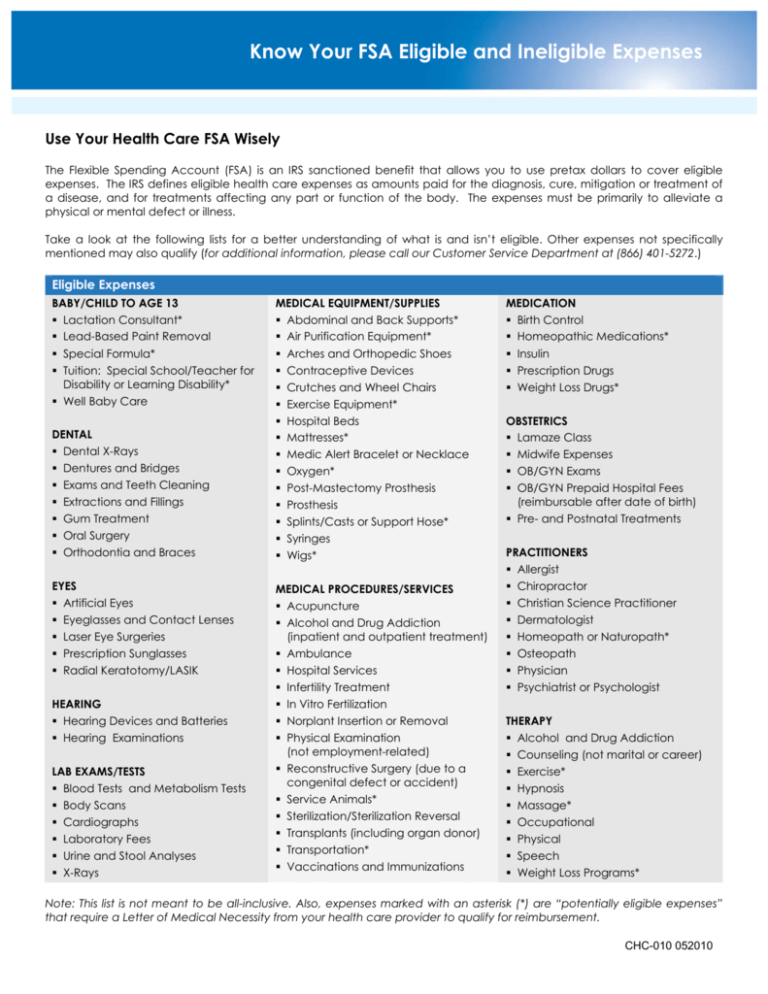

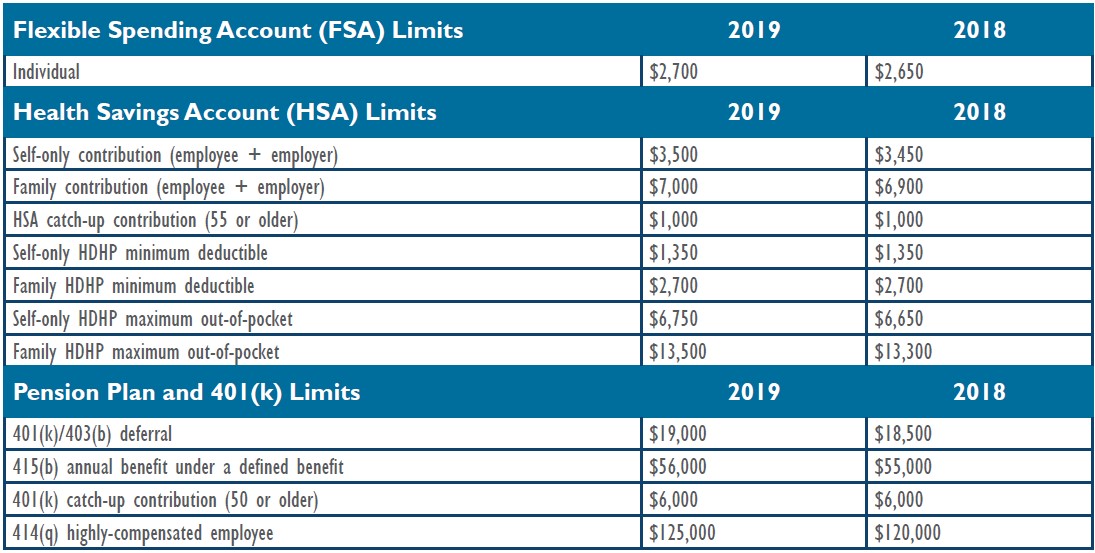

2024 Fsa Rollover Limit Over 50. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. The irs has just announced updated 2024 fsa contribution limits, which are seeing modest increases over 2023 amounts.

That’s a $150 increase from 2023. What you need to know.

2024 Fsa Rollover Limit Over 50 Images References :

Source: tarayaridatha.pages.dev

Source: tarayaridatha.pages.dev

Fsa Contribution Limits For 2024 Rollover Lacey Cynthea, Family members benefiting from the fsa have individual limits, allowing a married couple with separate.

.png) Source: tarayaridatha.pages.dev

Source: tarayaridatha.pages.dev

Fsa Contribution Limits For 2024 Rollover Lacey Cynthea, What is the 2024 maximum fsa contribution?

Source: corileonanie.pages.dev

Source: corileonanie.pages.dev

Limited Purpose Fsa Contribution Limit 2024 Over 55 Elli Malynda, That's a $150 increase from 2023.

Source: babitaymignonne.pages.dev

Source: babitaymignonne.pages.dev

How Much Fsa Rollover Into 2024 Calculator Minta Tamarra, The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

Source: danilaqbatsheva.pages.dev

Source: danilaqbatsheva.pages.dev

Fsa 2024 Limits Rollover Denys Felisha, The 2024 maximum health fsa contribution.

Source: adabkrystalle.pages.dev

Source: adabkrystalle.pages.dev

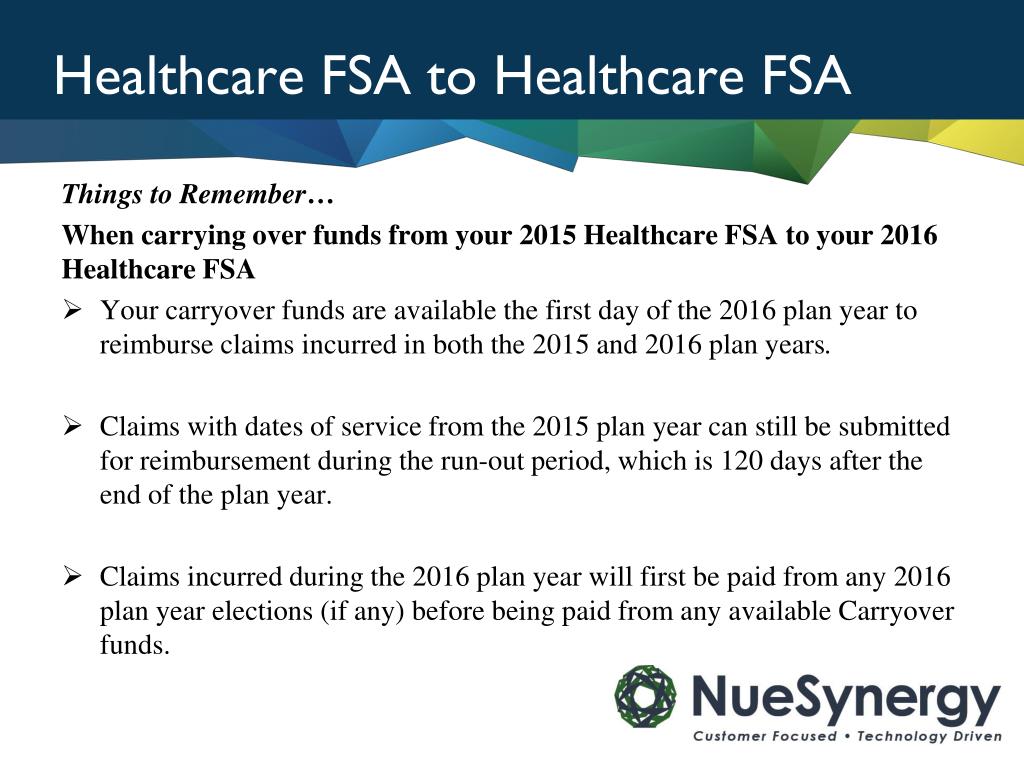

2024 To 2024 Fsa Rollover Limit Kelsy Maribeth, For cafeteria plans that allow the carryover of unused amounts, the maximum carryover amount for 2024 is $640.

Source: adabkrystalle.pages.dev

Source: adabkrystalle.pages.dev

2024 To 2024 Fsa Rollover Limit Kelsy Maribeth, 1, 2024, the contribution limit for health fsas will increase another $150 to $3,200.

Source: danniebmariya.pages.dev

Source: danniebmariya.pages.dev

Fsa Rollover 2024 To 2024 Calculator Elfie Helaina, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2024, which is a $30 increase from 2023.

Source: adorevceciley.pages.dev

Source: adorevceciley.pages.dev

Max Fsa Contribution 2024 Over 50 Vinny Jessalyn, For the 2024 plan year, employees can contribute a maximum of $3,200 in salary reductions.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, 403 (b) and 457 (b) retirement plans.

Posted in 2024