Current Sunglasseira Contribution Limits 2024 Roth. You can make 2024 ira. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

2024 contribution limits for different age groups: 401 (k) comparing contribution limits:

For Individuals Under 50, The Roth Ira Contribution Limit In 2024 Is $7,000, A $500 Increase From 2023.

Ira contribution limits for 2024.

Are You Allowed To Contribute The Maximum Amount?

Your roth ira contribution might be limited based on your filing status and income.

If You Are 50 And Older, You Can Contribute An.

Images References :

Source: alidaqroseann.pages.dev

Source: alidaqroseann.pages.dev

2024 Roth Ira Contribution Limits Allix Violet, For individuals under 50, the roth ira contribution limit in 2024 is $7,000, a $500 increase from 2023. The roth ira contribution limits will increase in 2024 in november, the internal revenue service published updated ira contribution limits for 2024.

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Roth 401k Limits Alice Brandice, For those 50 or older,. Fact checked by jiwon ma.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, In 2024, the roth ira contribution limit is $7,000, or. How much you can contribute is limited by your income level, filing status,.

Source: matricbseb.com

Source: matricbseb.com

Roth IRA Contributions Limit 2024 All you need to know about the Roth, The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger. The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older.

Source: elayneqmichell.pages.dev

Source: elayneqmichell.pages.dev

2024 Roth Contribution Limits Ellyn Hillary, The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited based on your filing status and income.

Source: www.msn.com

Source: www.msn.com

Roth IRA Contribution Limits for 2024, The irs has announced the increased roth ira contribution limits for the 2024 tax year. Ira contribution limits for 2024.

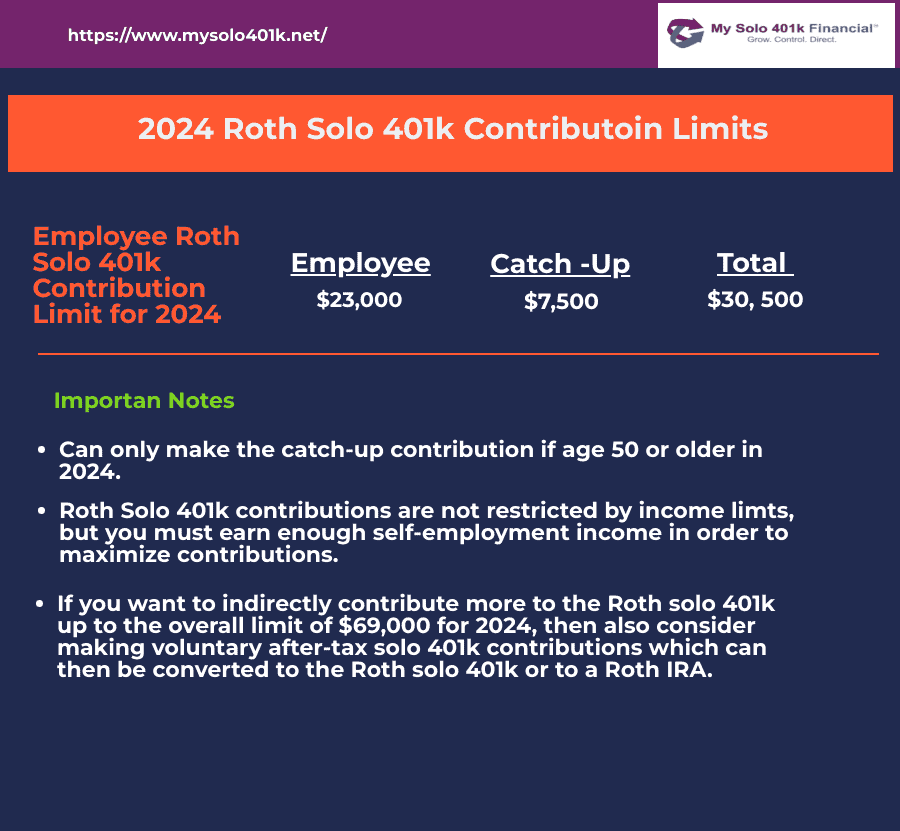

Source: www.mysolo401k.net

Source: www.mysolo401k.net

SelfDirected Roth Solo 401k Contribution Limits for 2024 My Solo, For those 50 or older,. For individuals under 50, the roth ira contribution limit in 2024 is $7,000, a $500 increase from 2023.

Source: choosegoldira.com

Source: choosegoldira.com

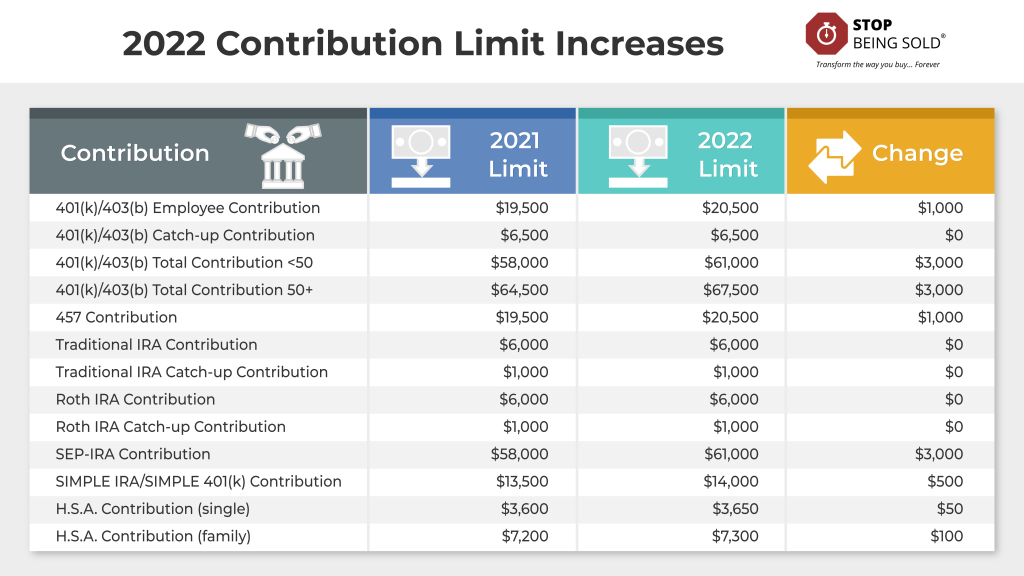

roth 457 contribution limits 2022 Choosing Your Gold IRA, If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2023 and $161,000 for tax year 2024 to contribute to a roth. 401 (k) comparing contribution limits:

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, If you are 50 and older, you can contribute an. The roth ira contribution limits in 2024 were raised to $7,000, or $8,000 for taxpayers 50 and older.

Source: us.firenews.video

Source: us.firenews.video

Roth IRA Contribution Limit 2024 2024 Roth IRA Contribution Limits in, 401 (k) comparing contribution limits: Less than $230,000 if you are married filing jointly or a qualifying.

How Much You Can Contribute Is Limited By Your Income Level, So It's Crucial To.

For 2024, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined.

In 2024, The Roth Ira Contribution Limit Is $7,000, Or.

The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.