Washington State Estate Tax Rates 2024. Eight states and the district of columbia are next with a top rate of 16 percent. The washington state estate tax exemption is currently $2.193 million.

Estate tax rates in washington state are progressive and range from 10% to 20%. Median real estate tax paid:

Hawaii And Washington Have The Highest Top Rates In The Nation At 20 Percent.

The median washington property tax is $2,631.00, with exact property tax rates varying by location and county.

See States With No Income Tax And Compare Income Tax By State.

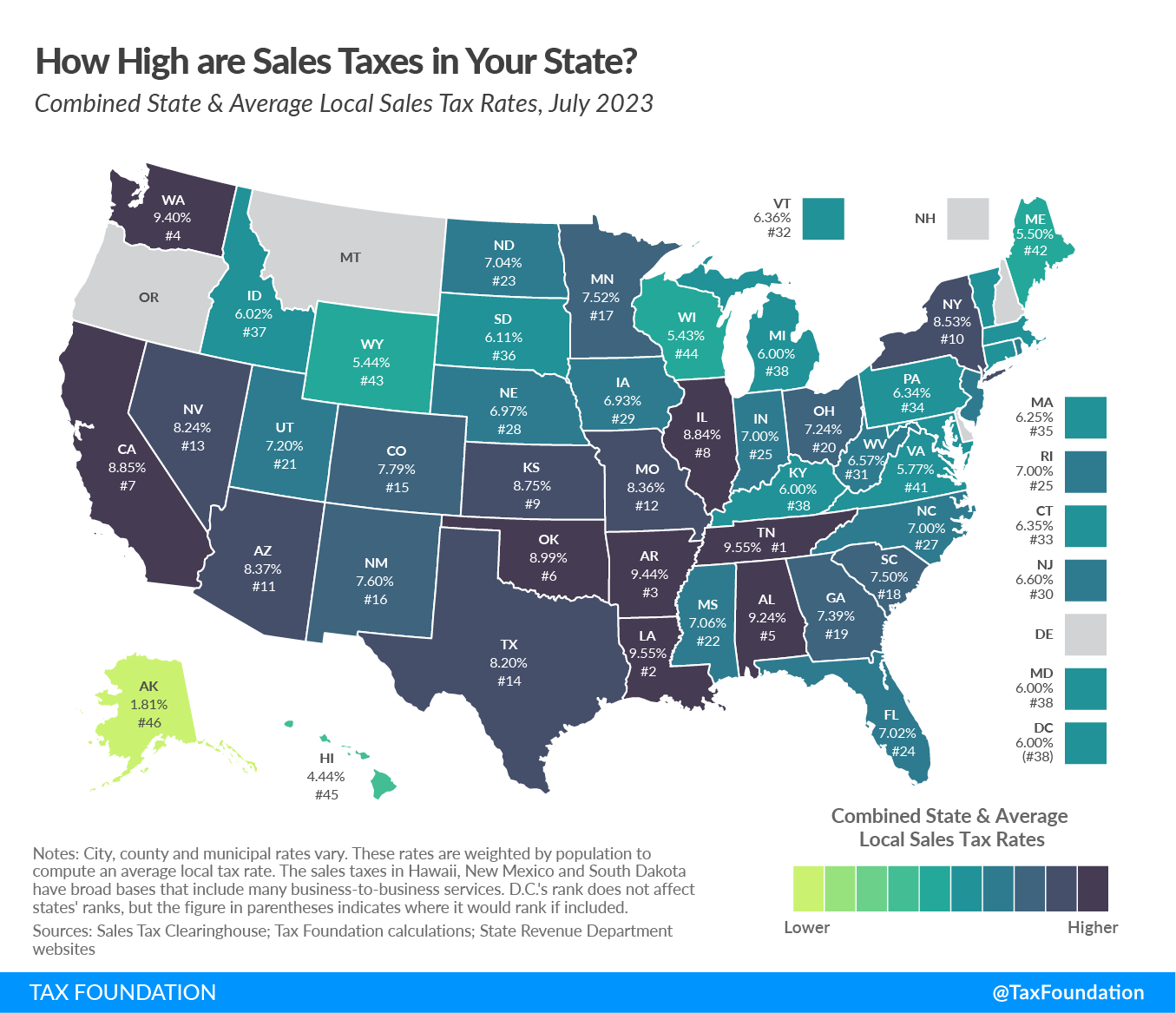

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations.

Washington State Estate Tax Rates 2024 Images References :

Source: kieleqserene.pages.dev

Source: kieleqserene.pages.dev

Washington State Estate Tax Rates 2024 Tedda Gabriell, The three counties in north carolina with the highest effective property tax rates are washington and edgecombe counties. See states with no income tax and compare income tax by state.

Source: bariqviviana.pages.dev

Source: bariqviviana.pages.dev

2024 Property Tax Rates Esta Olenka, The tax rates for the washington state estate tax range from 10% to 20%, depending on the value of the estate. Estate tax rates in washington state are progressive and range from 10% to 20%.

Source: kalilawclaire.pages.dev

Source: kalilawclaire.pages.dev

Inheritance Tax Changes 2024 Clem Melita, Estate tax rates in washington state are progressive and range from 10% to 20%. The current maximum rate of 20% applies once the washington taxable estate (generally, the value of assets in excess of the washington state estate tax.

Source: www.retirementwatch.com

Source: www.retirementwatch.com

Understanding the Estate Tax Retirement Watch, Estate tax rates in washington state are progressive and range from 10% to 20%. Use our local tax rate lookup tool to.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, This table gives an overview of the washington state estate tax based on the value of assets you pass on, the minimum taxes owed based on the value of your. 1 if you’re a washington resident and you’re starting to think about estate planning, this.

Source: fleurqnataline.pages.dev

Source: fleurqnataline.pages.dev

Tax Brackets 2024 Washington State Chart Melba Simonne, Our team provides a cheat sheet for your 2024 federal & state estate, gift, and gst taxes, including information on exemptions and rates. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and annexations.

Source: dorriqmaryann.pages.dev

Source: dorriqmaryann.pages.dev

Federal Estate Tax Rates 2024 Norah Annelise, Laws surrounding estate and gift tax rates change annually. Thus, at your death you are allowed to pass on $2,193,000 estate tax free at the state of.

Source: amirosette.pages.dev

Source: amirosette.pages.dev

Tax Rates 2024 2024 Stefa Emmalynn, Hawaii and washington have the highest top rates in the nation at 20 percent. For 2024, estate tax exemptions are higher.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, The washington state estate tax exemption for 2024 remains at $2,193,000. A chart that provides the key washington estate tax figures for 2023 and 2024, including the estate tax exemption amount and top rate.

Source: chelsiewcarina.pages.dev

Source: chelsiewcarina.pages.dev

Washoe County Sales Tax Rate 2024 Cori Joeann, For 2024, estate tax exemptions are higher. The tax rate goes up as the estate value goes up, following a.

The Tax Rate Goes Up As The Estate Value Goes Up, Following A.

The median washington property tax is $2,631.00, with exact property tax rates varying by location and county.

The Washington State Estate Tax Exemption Is Currently $2.193 Million.

This exemption amount has not increased since 2018 because the cost of.

Category: 2024